Apr 19, 2017

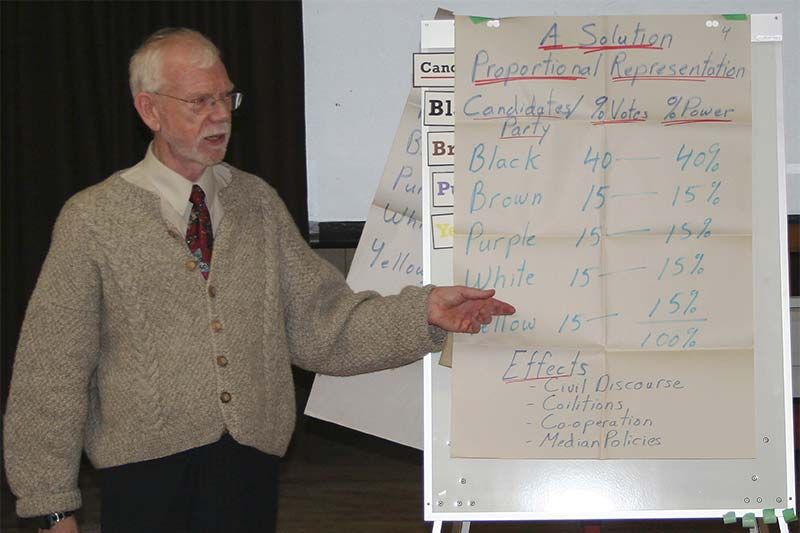

“The closer you come to true proportionality, the more complex it becomes,” speaker Norm Hart told a discussion group gathered in Sharbot Lake’s Oso Hall last week. “(So) you can never achieve true proportionality.”

Hart’s part of the evening was focused on the different voting systems democracies use around the world.

In his talk, ‘Making Every Vote Matter,’ he explained the differences, similarities, strength, weaknesses and nuances of various systems used to achieve proportional representation, ie where the number of seats a party gets in a ruling body is wholly or in part based on the percentage of popular vote.

Hart outlined several alternatives to the current First-Past-The-Post system including the Single Member Party Proportional System, Multi-Member Proportional System, and ranked balloting.

He and his Citizen’s Democracy Forum compatriots advocate the Single Member Party Proportional System whereby all members are still elected and vote but their votes are weighted the portion of the popular vote they receive.

“Under this system, Elizabeth May would get 10 votes whereas each Liberal MP would get 0.9 of a vote,” he said. “It’s not that different from the current system in that we wouldn’t have to change any ridings but it would force members to have to talk to each other.”

He said this system requires a “threshold” of having to elect at least one member and getting 3 per cent of the total vote in order to prevent “fringe” candidates from creating an unworkable parliament.

The second part of the evening was turned over to Wagerville’s own Jerry Ackerman, who has a PhD from Purdue University in agricultural economics.

Ackerman’s presentation was less lecture and more debate stimulation as he and Herb Wiseman of Comer.org led a discussion of how the federal government’s fiscal policies have led to crippling interest payments on a public debt in excess of $600 billion.

Ackerman maintains that when Canada joined the international finance system in 1974, the Bank of Canada stopped funding the government and we began to borrow the needed funds from private banks.

“The consequence of this is that the compounded interest now owed to the private banking system meant less money available for the needed goods and services (hospitals, schools, roads) while the private banks have reaped enormous profits,” he said. “What a scam.”

Ackerman advocates a return to using the Bank of Canada instead of private banks.

“Until recently, most of us assumed that states can’t go bankrupt,” he said. “We have now learned our assumption was illusory.

“What happened in Japan, Asia, Latin American and recently in Portugal, Iceland, Ireland, and Greece can happen in the U.S., Canada, England, France or Germany.

“The decisive factor here is not the absolute level of debt, but the rapid growth of interest burden this debt entails, resulting from compound interest.”

More Stories

- No Winner Yet in Catch The Ace But Fundraising Target Met

- South Frontenac Food Bank Opens Second Location in Battersea

- Sharbot Lake Pentecostal Church Anniversary - 1925-2025

- Frontenac Holistic Health Fair - September 20 At Storrington Centre

- Odd Year For Real Estate - But Sales Are Steady Year Over Year

- 193rd Kingston Fall Fair

- Kim Phuc - the Napalm Girl - To Visit Flinton In November

- South Frontenac Council - September 2

- Sticker Shock - EV Charging Station To Cost North Frontenac Township

- 30th Anniversary Verona Car Show